NBFC Software for Your Non-Banking Financial Company

LOS, LMS, Accounting and more | Digital Lending Software for NBFCs

Request a Quote

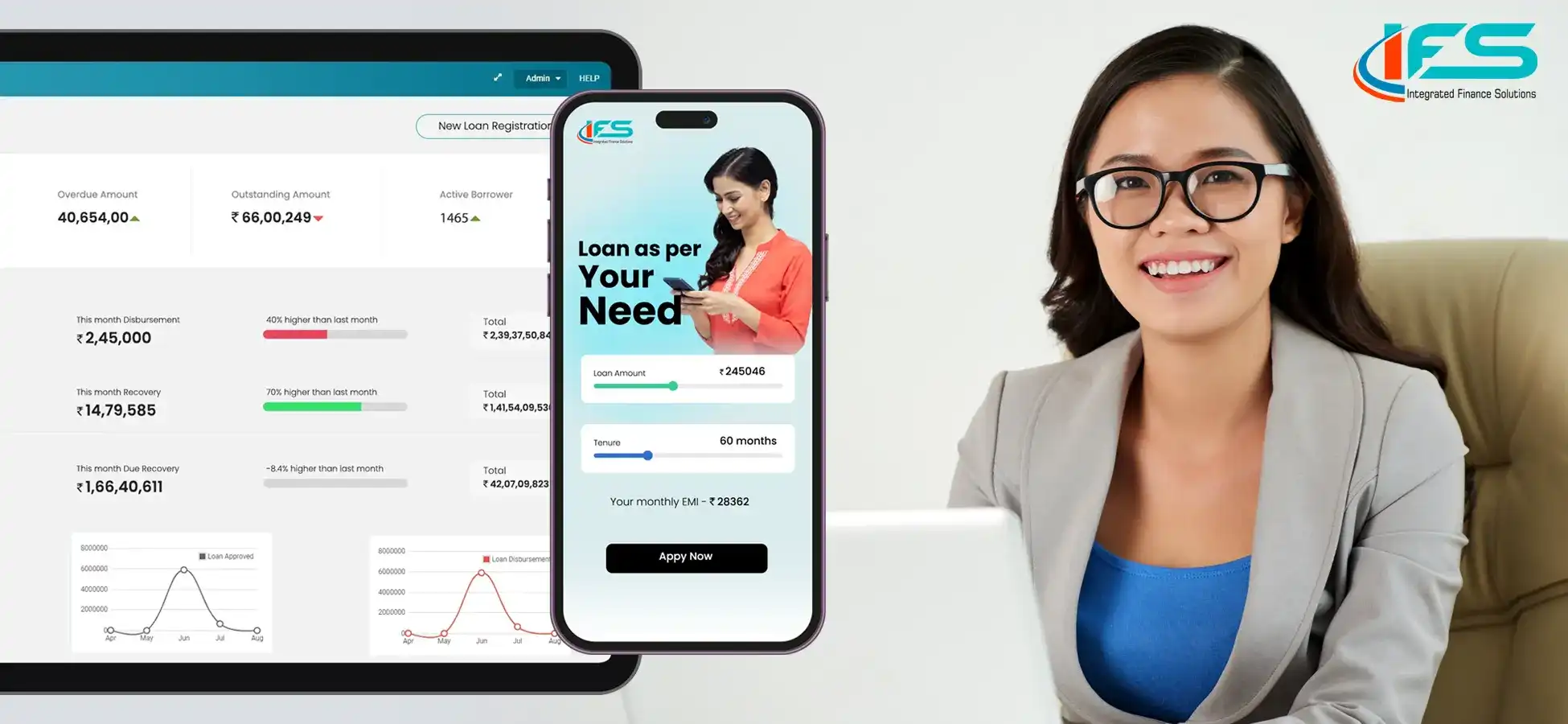

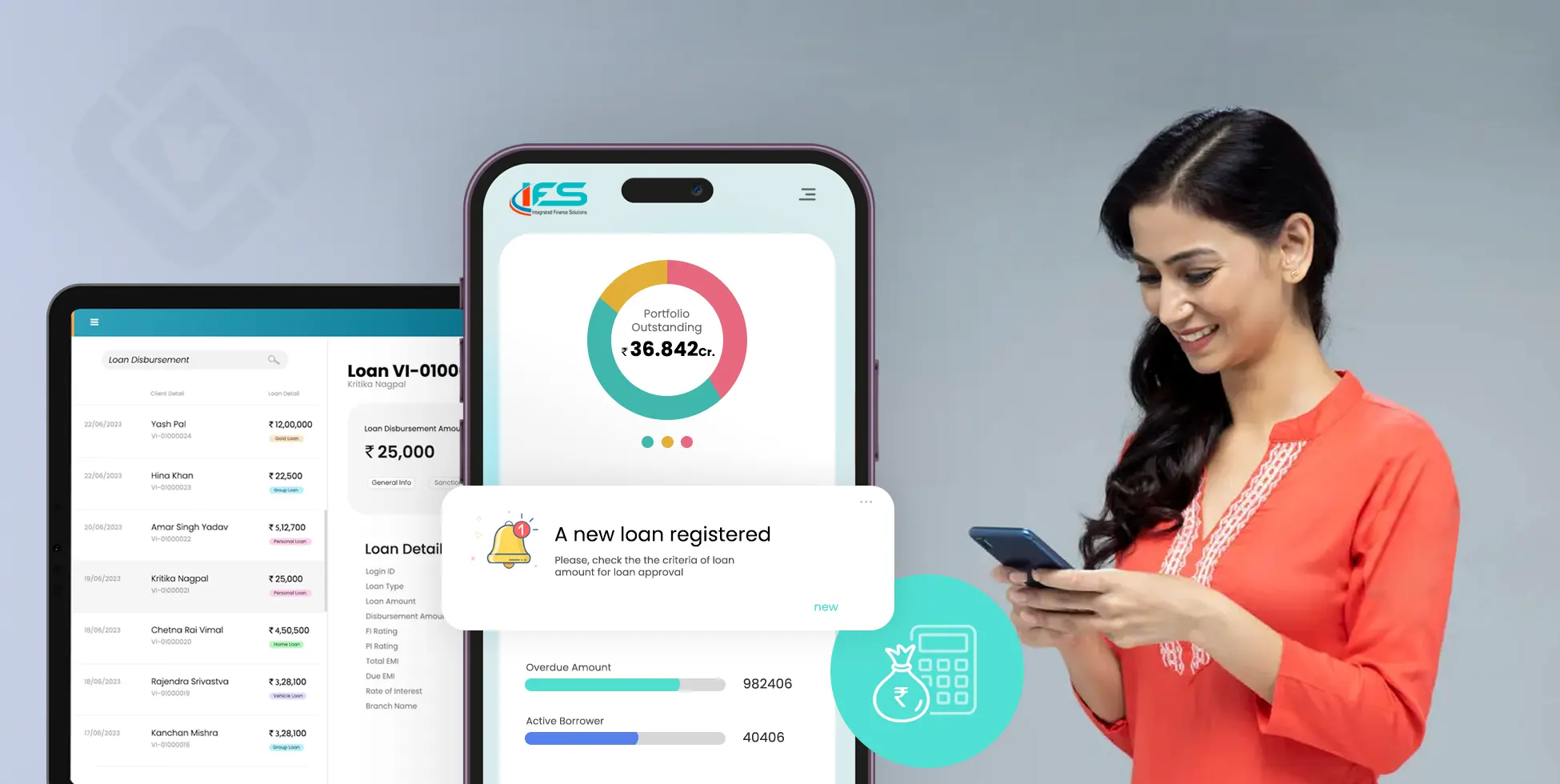

CLOUD BASED DIGITAL LENDING SOLUTION

IFS is the industry-leading digital lending solution suite that is powering traditional and emerging financial institutions in over 50 NBFC - Companies drive truly digital transformation. IFS offers a cloud based digital Lending solution that help NBFC achieve frictionless customer experiences, larger ecosystem, insights-driven interactions and universal automation.

MANAGE THE COMPLETE LOAN LIFECYCLE

IFS NBFC Software is a wide-ranging, integrated, customizable, pioneering solution, designed to manage the complete loan lifecycle. It enables companies to implement custom-made products within minutes and automate their business processes thus improving the overall operational efficiency.

Loan Management System for multiple loan types

IFS loan management software lets you manage any type of loans using its FORM-Power feature which can be used to create loan origination form for any type of loan.

Housing Loan

Vehicle Loan

Gold Loan

Personal Loan

Business Loan

Mortgage Loan

Scale your Loan Management Software as you grow.

Automation of routine processes

Centralized data storage

In-built analytic modules

Co-Lending with different Lenders

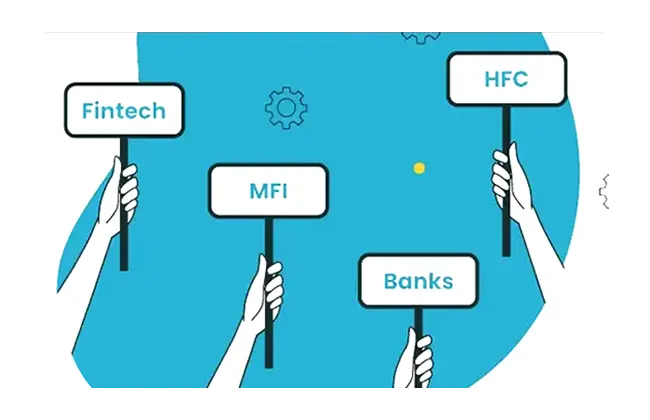

Third-party integration

Mobile Application

IFS Mobile application is for both borrower and field staff for monitoring, collection and apply new loan applications etc.

Responsive interface

Security

Support

Pricing and Plan

Choose the perfect software plan for your NBFC and scale your business seamlessly!

Price Revision Notice – Effective 1st April 2026

Due to continuous feature upgrades, AI/ML enhancements, and expanded integration capabilities, our pricing will be revised from 1 April 2026.

IFS Lite: ₹5,00,000 | IFS Pro: ₹15,00,000

Lock in current pricing by starting today!

IFS Lite

For Rising NBFCs | Core Loan

Management

- Basic integration for smooth operations

- LOS & LMS

- Single branch management

-

Manage any single loan product

- Group Loan

- Vehicle Loan

- Gold Loan

- Business Loan

- Wholesale Finance

- Equipment Loan

- Personal Loan

- Supply Chain Finance

- Asset Loan

- Loan Against Share

- Payday Loan

- Leasing Finance

- Android App only for Employee

- Paid customizable modules

-

Paid API Integration

- Cibil

- Equifax

- High Mark

- Statement Analysis

- E- Nach

- E- Sign

- E- Stamping

- UPI Collection

- GST Verifcation

- SMS & Whatsapp

-

AI / ML Features

- Geo-Tagging

- Geo-Fencing

- Adhaar Masking

- OCR for Auto Entry

- Power BI

- HR Management

- Account Management

- Inventory Management

- Legal Module

- Business Correspondent (BC) Model

- Wholesale Funding

IFS Pro

For Growing NBFCs | Multi-Branch & Advanced Features

- Advanced integration capabilities

- LOS & LMS

- Unlimited branch management

-

Manage any 2 loan products

- Group Loan

- Vehicle Loan

- Gold Loan

- Business Loan

- Wholesale Finance

- Equipment Loan

- Personal Loan

- Supply Chain Finance

- Asset Loan

- Loan Against Share

- Payday Loan

- Leasing Finance

- Android App for Employee & User

- Paid customizable modules

-

Free API Integration

- Cibil

- Equifax

- High Mark

- Statement Analysis

- E- Nach

- E- Sign

- E- Stamping

- UPI Collection

- GST Verifcation

- SMS & Whatsapp

-

AI / ML Features

- Fully Customizable Soutions

- Geo-Tagging

- Geo-Fencing

- Aadhaar Masking

- OCR for Auto Entry

- KYC Match Anlysis

- CB Reporting Analysis

- Bank Statement Analysis

- Predective Loan Default Analysis

- Fraud Detection & Prevention

-

Power BI

- Interactive Dashboards

- POS Analysis

- Bucket/Aging Analysis

- PAR Analysis

- Employee Performance Analysis

- Repayment Trends Analysis

- Portfolio Cut Analysis

- Operational Cost Analysis

- Fraud Detection & Prevention Revenue Growth Insights

- Realtime Data Analysis

- HR Management

- Account Management

- Inventory Management

- Legal Module

- Business Correspondent (BC) Model

- Wholesale Funding

IFS Enterprise

For Large NBFCs | Customizable & Scalable

- Advanced integration capabilities

- LOS & LMS

- Unlimited branch management

-

Manage any loan products

- Group Loan

- Vehicle Loan

- Gold Loan

- Business Loan

- Wholesale Finance

- Equipment Loan

- Personal Loan

- Supply Chain Finance

- Asset Loan

- Loan Against Share

- Payday Loan

- Leasing Finance

- Android App for Employee & User

- Free customizable modules

-

Free API Integration

- Cibil

- Equifax

- High Mark

- Statement Analysis

- E- Nach

- E- Sign

- E- Stamping

- UPI Collection

- GST Verifcation

- SMS & Whatsapp

-

AI / ML Features

- Fully Customizable Soutions

- Geo-Tagging

- Geo-Fencing

- Aadhaar Masking

- OCR for Auto Entry

- KYC Match Anlysis

- CB Reporting Analysis

- Bank Statement Analysis

- Predective Loan Default Analysis

- Fraud Detection & Prevention

-

Power BI

- Interactive Dashboards

- POS Analysis

- Bucket/Aging Analysis

- PAR Analysis

- Employee Performance Analysis

- Repayment Trends Analysis

- Portfolio Cut Analysis

- Operational Cost Analysis

- Fraud Detection & Prevention Revenue Growth Insights

- Realtime Data Analysis

- HR Management

- Account Management

- Inventory Management

- Legal Module

- Business Correspondent (BC) Model

- Wholesale Funding

Our Finance Sector Clients

We are trusted by

FAQs About NBFC Software

Ans: IFS (Integrated Finance Solutions) is a powerful nbfc software solution designed for Non-Banking Financial Companies (NBFCs) by Vexil Infotech. It streamlines and automates various operations like loan management, customer relationship management (CRM), accounting, compliance, and reporting, tailored to the unique requirements of NBFCs.

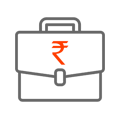

Ans: IFS NBFC software enhances operational efficiency by automating processes, reducing manual errors, and improving customer service. It enables better risk management, regulatory compliance, and data security while providing real-time insights for informed decision-making.

Ans: Our NBFC software includes features like loan origination, underwriting, collections management, EMI calculation, credit scoring, document management, integration with credit bureaus, accounting modules, and comprehensive reporting.

Ans: Yes, our reputable NBFC software providers offer customization options to align the software with your company's specific workflows, business rules, and branding.

Ans: Our top-notch NBFC software prioritizes data security. It employs encryption, user access controls, regular security audits, and compliance with data protection regulations to safeguard sensitive financial and customer data.

Ans: Yes, IFS is designed to integrate with third-party systems, such as credit bureaus, payment gateways, accounting software, and more, for seamless data flow and enhanced functionality.

Ans: IFS (NBFC software) comes with built-in compliance features that help automate adherence to regulatory requirements and reporting. This reduces compliance risks and eases the audit process.

Ans: IFS (NBFC software) offers training sessions and user documentation to ensure your team can effectively utilize all the features of the software.

Ans: Yes, our NBFC software solution offers data migration services, ensuring a smooth transition from your existing systems while preserving historical data.

Ans: Yes, We offer ongoing technical support, updates, and troubleshooting to address any issues that may arise during software usage.

Ans: Absolutely. Our NBFC software includes CRM capabilities that help NBFCs manage customer interactions, handle queries efficiently, and provide personalized services.

Ans: Yes, our NBFC software can be tailored to various types of NBFCs, such as asset finance, microfinance, housing finance, and more, accommodating their specific needs.

Ans: Consider factors like the software's features, scalability, customization options, security measures, integration capabilities, vendor reputation, and user reviews when choosing the right NBFC software for your business.

Ans: We offer demo to showcase the our software's capabilities and help you assess if it meets your requirements.

Ans: While there's an initial investment, our NBFC software's long-term benefits, including increased efficiency, reduced operational costs, and improved decision-making, make it a cost-effective solution for NBFCs in the competitive financial landscape.

For businesses and ideas of all sizes

If you're a big bank looking for a custom-built solution, a growing fintech looking for a technology partner or a small business looking for the tools to enable your ideas – we’ve got you. Our platform is built to enable ideas of all shapes and sizes.

Interested in how IFS can help your business?